Unlocking Local Insights, Driving Global Impact

Harness the power of data-driven intelligence and get actionable insights quickly and cost-effectively. With a global reach spanning over 140 countries, we’re empowering decision-makers to navigate today’s complexities and create meaningful changes.

Trusted by Industry Leaders Worldwide

Global Demand, Local Supply

From seeing where your product sits on the shelf to learning where the public stands on a topic, our solutions deliver insights to your fingertips.

25M+

Submissions per Year

6M+

Contributors Worldwide

2.3M+

Unique Points of Interest

Insights for Any Industry

Consumer goods companies

Premise accelerates retail sales for the world’s biggest CPG brands with actionable store-by-store Execution Intelligence.

International development

Traditional data collection is slow, costly, and complex. Premise offers end-to-end solutions for insights generation focused on maximizing impact.

Public sector

Premise enables public sector customers to understand local communities at a global scale through directly sourced data insights.

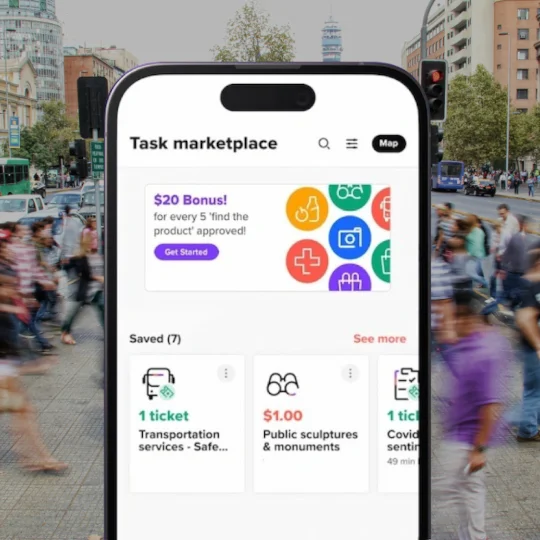

How Premise Works

Our sophisticated market intelligence platform blends machine learning with human intelligence, making it possible to quickly gather and analyze local insights from a curated and trusted global network.